Are you a licensed life and health insurance agent who wants to understand the ins and outs of working with a General Agency? If so, this article is for you! Continue reading to learn why every agent needs a good GA.

You can jump around using the links below:

- The basic definition of General Agency

- Services offered by a General Agency

- Pros & Cons of working with a General Agency

- Conclusion

What is a General Agency?

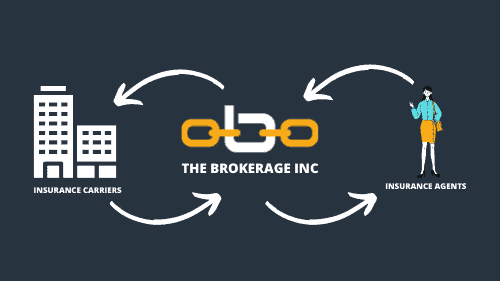

A General Agency (GA) is the link between independent insurance agents and insurance carriers. The best GAs can offer top-level contracts with the most popular health insurance carriers.

When selling insurance, it’s important to have a dedicated back-office support team that can help with training, certifications, marketing, recruiting, and other needs so that you can focus on scaling your business.

What Services are Offered by a GA?

Each General Agency differs in its unique offerings, but most will offer essential services such as contracting, credentialing, and education. There are many GAs to choose from, but they are not all created equal.

Some General Agencies have only been around for a couple of years, while others have been successful for many decades.

For example, agents contracted through The Brokerage get access to several unique offerings:

- The Broker Link – an exclusive agent portal that gives you access to a full suite of sales technology resources

- Brokerage Bucks – an exclusive marketing program where the more you sell, the more marketing dollars you earn

- Flexible Training – whether you want to attend an event or watch a webinar, The Brokerage gives you several learning options

- Digital Marketing – if you’re looking to build a website, improve your local SEO, or run paid advertising, we can help

- Recruiting Events – If you’re looking to recruit agents for your agency, The Brokerage has a proven system you can use

What are the Pros & Cons of Working with a General Agency?

Most health insurance carriers require you to work through a General Agency to obtain a contract, because they prefer to focus on their products while delegating agent support to companies like The Brokerage.

Some carriers offer direct contracts, but this comes with the expectation that you will sell a specified number of policies – otherwise they will terminate your contract.

Building a successful insurance business is a massive undertaking. Life is so much better when you have a team of people who are dedicated to your success – GAs only make money when you make money.

A good GA takes care of all of the back-office requirements set by the insurance carriers and empowers you to sell more, earn more, and stay independent.

Conclusion

Now that you understand the benefits of partnering with a General Agency, we recommend that you check out our free guide for how to choose the best one for you. If you have any questions, you can always give us a call and we’d be happy to help.