Are you interested in selling insurance? If so, this might be the best decision you’ve ever made. According to the Bureau of Labor Statistics, employment of insurance sales agents is projected to grow 7% over the next decade!

Insurance agents help clients understand insurance policies and choose a plan that best fits their needs. There is more opportunity than ever to sell Medicare, health, and life insurance.

Continue reading for our step-by-step guide on selling insurance.

You can jump around using the links below:

- How much money can you make selling insurance?

- Know the difference between a captive and independent agent

- Decide which insurance products you want to sell

- Get your insurance license

- Find an independent marketing organization

- Prepare for success

How much can you earn selling insurance?

The insurance industry is categorized under the financial services sector, where there is a famous saying: “There’s a lot of money in the money business!”

Many Americans find themselves trapped in the rat race, where it feels like they pay everyone else first.

One example we commonly refer to is a dishwasher who earns $9 per hour. He earns the same amount of money whether he washes 95 dishes in an hour or 100.

In other words, effort ≠ outcome.

Question: So how much can you make selling insurance?

Answer: You can make an unlimited amount of money selling insurance!

This is because you get to build a book of business that scales as you add new clients. For example, let’s say you were to sell 25-30 Medicare policies.

You could expect to earn around $10,000 in annual commission, and if you retain those clients, you will continue to receive renewal income every month!

Selling insurance allows you to generate passive income, and it’s also shown to be stable in times of economic uncertainty. Take, for example, the COVID-19 pandemic.

Thousands of businesses had to close down and could not recover their losses. Meanwhile, everyone still needed life and health insurance.

For more information on how much money you can make selling insurance, check out this in-depth article.

Captive vs. Independent Agent

When selling insurance, it is essential to understand the differences between captive and independent agents.

A captive agent works as an employee at an insurance company, offering stability and support from the company. However, there are limitations to being a captive agent, such as the inability to expand your portfolio beyond the company’s offerings and not owning your book of business.

If you part ways with the company, you leave your income source behind.

On the other hand, an independent agent enjoys greater control over their destiny.

Independent agents are free to offer a wide range of products and work with multiple carriers, providing clients with more options for finding the best policies and prices.

Additionally, independent agents can build a book of business that is truly their own asset, benefiting both themselves and their families.

At The Brokerage, our independent agents are 100% vested from day one, giving them full ownership of their book of business right from the start.

This ownership provides independence and flexibility in serving clients and growing their business in the insurance industry.

Decide which products you want to sell

Over the next decade, an average of 10,000 Baby Boomers will turn 65 and qualify for Medicare daily.

On top of this, four out of five consumers under age 65 are now able to find ACA health insurance for under $10 a month.

And with consumer debt at an all-time high, it’s important for families to protect their loved ones with life insurance.

All of these potential clients need help understanding their options, and you can make a great living by helping people with this important matter.

At The Brokerage, we offer products from all of the top insurance carriers:

- ACA Health Plans

- Ancillary Products

- Annuities

- Critical Illness Insurance

- Dental, Vision, and Hearing Insurance

- Group Insurance

- Hospital Indemnity

- International Travel Insurance

- Life Insurance

- Long Term Care Insurance

- Medicare Advantage

- Medicare Supplements

- Short Term Major Medical

If you set up an account on The Broker Link (new link is pending), you can research which carriers are most popular in your region and decide what you want to sell.

Get your insurance license

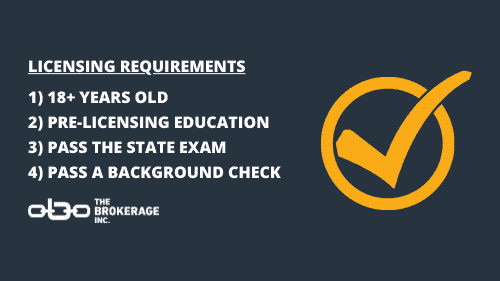

Here are the basic insurance licensing requirements:

- Be at least 18 years old

- Complete pre-licensing education

- Pass the state insurance licensing exam

- Pass a background check

If you meet the basic requirements and are willing to commit to taking continuing education courses each year, you can continue on to enroll in an exam preparation course and then pass your state licensing exam.

Becoming a licensed insurance agent typically takes a few weeks for most individuals, and it does not require a bachelor’s degree.

The exact timeline can vary depending on the individual’s pace of completing required education courses, which can often be done online.

These courses may require a certain number of study hours to complete. Once the education requirements are met, applicants must pass an exam and undergo background checks.

After these steps are completed, there may be an additional waiting period of approximately one to two weeks for the license to be issued.

Check out our complete guide for getting your insurance license here.

Find an independent marketing organization

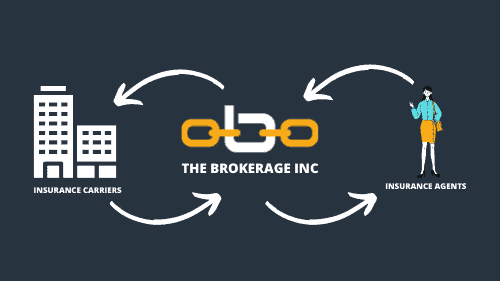

Commonly referred to as FMO, IMO, or GA, an independent marketing organization links an insurance carrier and an independent insurance agent.

You’ll want to make sure you choose an independent marketing organization that offers the carriers and products you’ve chosen. You’ll also want to make sure they offer fully vested contracts, training, support, technology, and a solid reputation.

Selling insurance can be overwhelming when you’re working alone, which is why it’s so important to choose the right independent marketing organization. Find a group that empowers you to sell more, earn more, and stay independent.

For more on how to find the right independent marketing organization, check out this guide.

Prepare for Success

Once you are licensed and you’ve chosen an independent marketing organization, it’s time to prepare for success.

The first thing to do is leverage your network. Let others know that you can now help them and their family with insurance, and make it easy to share your information.

Secondly, plug into your independent marketing organization’s training & marketing programs to find out how you can kick-start your book of business.

If you have a day job, we recommend that you start by selling insurance on the side to remove unnecessary pressure and focus on building a sustainable business. Beyond that, the sky’s the limit.

At The Brokerage, you can start selling insurance by setting up a free account in The Broker Link.

There, you can get contracted with insurance carriers, learn about our exclusive marketing programs, access our on-demand training, and so much more!