Whether you want to work as an independent insurance agent or as a captive employee, you must be licensed with each state in which you want to sell insurance. Continue reading for a step-by-step guide on how to get your insurance license.

You can jump around using the links below:

- Decide on your insurance products

- Know the licensing requirements

- Go through an exam prep course

- Pass the state licensing exam

- Contracting with insurance carriers

Decide What Products You Want to Sell

Did you know that over the next decade, an average of 10,000 Baby Boomers will turn 65 and qualify for Medicare every single day?

Each of these consumers needs help understanding their options, and you can make a hefty commission by helping them.

For many consumers under age 65, health insurance has become more affordable than ever as a result of the Affordable Care Act.

According to the Centers for Medicare and Medicaid Services, four out of five consumers are now able to find coverage for under $10 a month, and they consequently need brokers to assist them in making a decision.

At the time of writing this article, the total U.S. consumer debt is at $14.9 trillion, which includes mortgages, auto loans, credit cards, and student loans. In other words, millions of Americans have family members who depend on them for income, and if they were to die, these debts would be passed down to their loved ones.

Selling life insurance is a great way to do some good by helping people alleviate this concern.

Understand the Licensing Requirements

After you’ve decided what kind of insurance agent you want to be, the next step is to understand the basic requirements:

- Be at least 18 years old

- Complete pre-licensing education

- Pass the state insurance licensing exam

- Pass a background check

Along with the prerequisites mentioned above, you must commit to taking continuing education courses each year to keep your insurance license active.

Now that you understand the basic licensing requirements, it’s time to enroll in an exam preparation course.

Enroll in an Exam Preparation Course

There are several exam preparation courses to choose from. If you Google “insurance license exam prep” you will see a comprehensive list of options.

For example, many of our agents have found success through Kaplan Financial Education. You can choose from structured or self-study exam prep packages, live and online classes, and individual study tools.

Kaplan’s study tools include:

- License Exam Manual

- State Law Supplement

- InsurancePro™ QBank

- Study Calendar

- Video & Audio Review

- InstructorLink™

- Pre-Study Assessment

- Mastery Exam

- Checkpoint Exams

- Certification Exams

- Flashcards

- Insurance QuickSheets

Wherever you decide to study for the insurance license exam, take your time and try not to overthink it. You don’t need to get an A on the exam to become licensed – there’s no GPA to worry about like when you go to college.

Pass Your State Insurance License Exam

Each state has its own process for insurance licensing. If you do a Google search for “State Name department of insurance – get licensed” you should be able to find the instructions for your state.

For example, in the State of Texas the instructions are as follows:

- Make an examination reservation with Pearson VUE and pay the fee.

- Make a fingerprint reservation with IdentoGO by IDEMIA for the digital fingerprint.

- Take the examination. Go to the test center on the day of the examination, bringing along all required materials.

- Get fingerprinted. Go to the designated fingerprint site at the appointed day/time, bringing along all required materials.

- Apply for a license. Apply electronically for your license as directed at www.sircon.com/texas after you have passed the exam.

Make sure to do your research on your state’s requirements, then take everything you’ve learned in your exam preparation and knock it out of the park. You can do it!

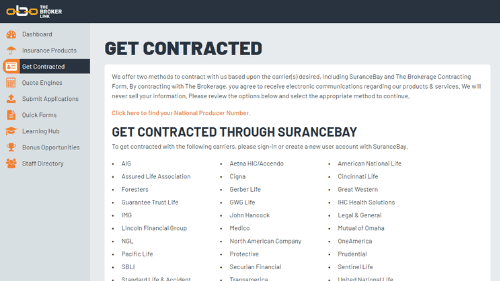

Get Contracted with Insurance Carriers

Once you have become a licensed insurance agent and have decided which products you want to sell, it’s time to get contracted with insurance carriers. The contracting process varies for each carrier, but our team is here to make it as easy as possible.

If you set up a free account on The Broker Link, you can research which carriers are most popular in your region and request contracts – all within our agent portal.

Conclusion

Getting your insurance license can be an excellent decision, as there is more opportunity than ever before for selling Medicare insurance, health insurance, and life insurance. If you have any questions or you’re looking for a partner to grow your business, we’re here to help!