Are you thinking about selling Medicare?

Over the next decade, an average of 10,000 Baby Boomers will turn 65 and qualify for Medicare every single day.

Selling Medicare is a rewarding opportunity to help seniors understand their healthcare options and earn a generous commission.

Continue reading for our step-by-step guide on selling Medicare.

You can jump around using the links below:

- How much money can you make selling Medicare?

- Get your Medicare insurance license

- Decide which Medicare products you want to sell

- Find a good Medicare FMO

- Complete AHIP and carrier certifications

- Prepare for Medicare selling success

How much can you earn Selling Medicare?

Selling Medicare is part of the financial services industry, with a track record of generating more millionaires than any other industry.

One of the reasons that selling Medicare is so lucrative is your ability to make ongoing, residual income. When you work a job earning $15 per hour, your paycheck is the same regardless of how much effort you put into it.

With Medicare sales, you sell a policy and receive an initial commission (let’s say $600). Then, every year you retain that client, you receive ½ of the commission AGAIN in monthly payments.

If you can get your “book of business” up to several hundred clients, then you should have no problem making a six-figure income – all while getting to be your own boss! Check out this chart that shows you how it’s possible.

Selling Medicare can be a great way to make passive income, even during economic uncertainty. Regardless of what happens, seniors still need to see their doctor, pick up their prescription drugs, etc.

For more information on how much money you can make selling Medicare, check out this in-depth article.

Get Licensed to Sell Medicare

To sell Medicare, you must become a licensed life and health insurance agent in your state (or any state where you plan to sell).

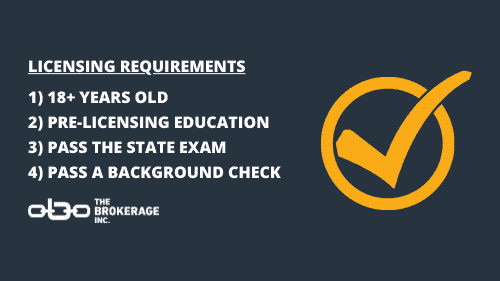

The basic insurance licensing requirements include the following:

- Be at least 18 years old

- Complete pre-licensing education

- Pass the state insurance licensing exam

- Pass a background check

If you meet these requirements and are willing to commit to further training and certifications, you will enroll in an exam preparation course and then pass your state exam.

We have a complete guide for getting your life and health insurance license here.

Decide Which Products You Want to Sell

There are many options when it comes to selling Medicare.

A Medigap plan (aka Medicare Supplement) is designed to “gap” or “supplement” Original Medicare. This plan gives the client freedom of choice, allowing them to go to any doctor or hospital that accepts Original Medicare. There is a premium with a Medigap plan; seniors often consider it a “pay upfront” plan.

A Medicare Advantage (MAPD) plan is a “pay as you go” plan. MAPD plans generally have a low or no premium, networks with doctors and hospitals assigned to them, and a max-out-of-pocket (MOOP). They usually include extra benefits like dental, vision, and hearing.

Medicare products are provided by private insurance carriers, each with pros and cons. Some of the most popular carriers include UnitedHealthcare, Aetna, and Humana, and many regional insurance carriers could be available in your market.

It is usually a good idea to start with the most competitive products in your area and add new ones as needed. A quality FMO can help you develop a product strategy if you are unsure where to start.

When considering where to obtain your senior market products and whether to utilize a Medicare FMO, it’s essential to understand the process thoroughly.

To sell Medicare products, you must secure appointments with insurance carriers by completing independent agent agreements or contracts.

Insurance companies often require agents to go through an FMO to access contracts, as direct contracts are limited for independent agents. Working with a Medicare FMO can offer numerous advantages.

Partner with a Medicare FMO

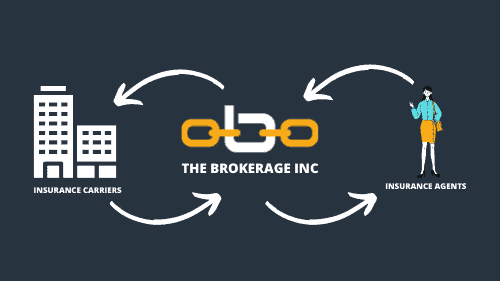

A Field Marketing Organization (FMO) is the link between Medicare insurance carriers and independent Medicare sales agents.

It’s important to partner with a reputable Medicare FMO that offers a good mix of carriers and products, fully vested contracts, training, support, and technology.

Working with a Medicare FMO can offer numerous advantages. A reputable FMO will help you secure contracts with top insurance companies, provide ongoing support, and enable you to focus on growing your business effectively.

Conduct thorough research and ask the right questions when selecting an FMO partner to ensure that they can help you achieve your goals and succeed in the senior market.

Selling Medicare can be overwhelming when you’re working alone, and that’s why companies like The Brokerage Inc. exist. A good FMO empowers you to sell more, earn more, and stay independent.

For more information, check out this guide on how to find the best Medicare FMO.

Complete AHIP & Carrier Certifications

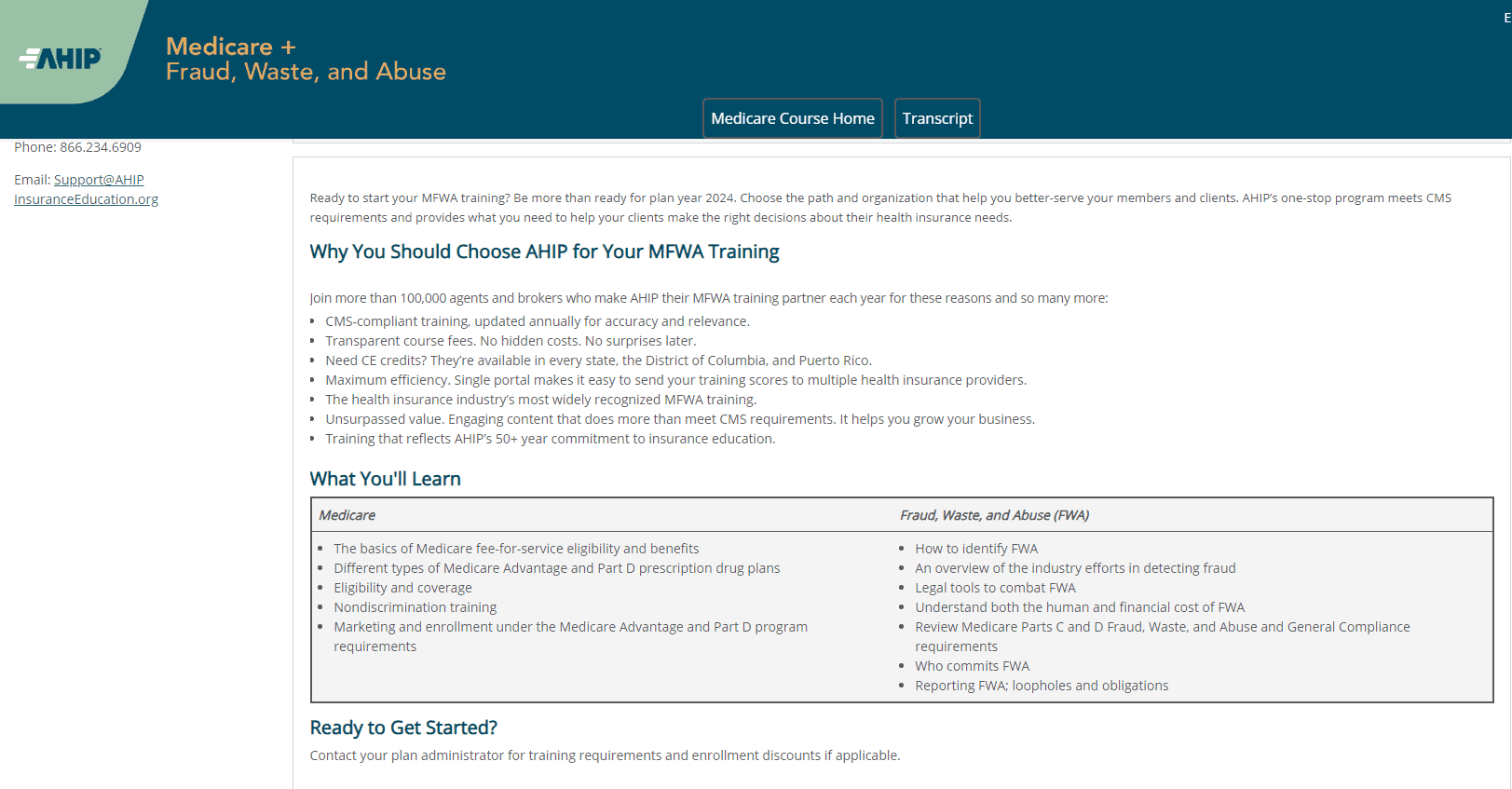

AHIP (America’s Health Insurance Plans) is an industry-recognized certification test. If you want to sell Medicare Advantage products, then you must become AHIP-certified for most carriers.

In addition to the AHIP, each carrier requires you to complete their unique certifications. Because Medicare Advantage is such a highly regulated product, the carriers want to make sure that you are correctly representing them.

For more information on the AHIP and other carrier certifications, click here.

Utilize a CRM and Quoting Platform

An Insurance CRM allows for efficient customer management, tracking client interactions, and managing leads and sales opportunities.

It enhances productivity by streamlining processes and providing insights into customer behavior and preferences.

A Medicare Quoting Platform facilitates quoting by providing agents access to accurate pricing and plan details for various products.

Ensure you are partnered with an FMO offering all the tech you need to succeed.

Develop a Strategy for Generating New Business

Now that you are licensed, contracted, and certified, it’s time to create your Medicare Business Plan. This includes setting your production goals, developing a lead generation and client retention strategy, and leveraging the support available through your Medicare FMO.

There are many ways to generate leads for your Medicare business. While no lead source may meet all your needs, success in working with insurance leads relies on recognizing that it’s a numbers game.

Consider the different ways you can interact with your customers.

Will you choose face-to-face visits, or do you prefer the convenience of electronic and phone communications?

Both approaches have their merits, especially since many reputable insurance companies now offer e-application processes for agents.

When marketing to seniors, remember the importance of building relationships. Understand their needs and preferences to offer them the best service and products.

Seniors are discerning customers who can quickly see through insincere sales tactics. Approach your sales with honesty and a genuine desire to help, as this will resonate with them and build trust.

Initially, we recommend keeping your day job and selling Medicare on the side. This will remove unnecessary pressure and enable you to focus on building a sustainable business.

At The Brokerage, you can start selling Medicare by setting up a free account in The Broker Link.

There, you can get contracted with Medicare insurance carriers, learn about our exclusive marketing programs, access our on-demand training, and so much more!