With 10,000 Baby Boomers turning 65 every day, it’s a great time to create your Medicare business plan!

This article discusses the core areas to focus on when creating your Medicare business plan, such as production goals, lead generation, client retention, marketing co-op, and more.

Set Production Goals

Whether you’re a full-time agent or you’re selling Medicare as a side gig, there is a lot of money to be made in this business. With so many people needing your expertise, you can take great pride in your work.

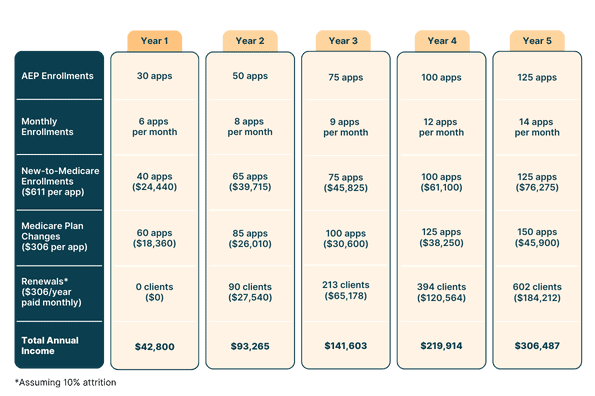

The following chart estimates what you could earn by setting measurable sales goals. In year one, we recommend that you aim to sell 40 new Medicare policies and 60 policies to individuals who were already on a Medicare plan. This results in a year-one income of $42,800.

It may not sound like much at first, but thanks to renewal income, this begins to scale very quickly. Even if you lose 10% of your book of business each year (the industry average), you can expect to earn $306,487 by year 5.

The key idea is to set realistic goals and patiently stick with them. “All who have accomplished great things have had a great aim, have fixed their gaze on a goal which was high, one which sometimes seemed impossible.” – Orison Swett Marden

Network with Providers

Doctor’s offices, senior centers, and gyms are all great places to generate activity for your Medicare business. Find out who the gatekeeper is and introduce yourself as someone who can help their members with Medicare coverage.

Our Medicare Sales Director, Evette Rodney, advises agents to visit each office every 30 days for the first 90 to 120 days to establish trust and rapport. On the initial visit, the focus should be on introducing yourself, leaving behind marketing materials, and asking about flyer placement.

At the 30-day mark, check-in, replenish any materials left behind, and offer to host a lunch and learn. This allows you to educate office staff on new plan benefits while providing value.

Follow-up continues at 60 days with relationship building. Avoid asking for referrals prematurely before establishing goodwill.

After 90 to 120 days of consistent outreach, agents can consider requesting formal affiliation letters from engaged offices. But the work doesn’t stop there – regular visits should continue to nurture partnerships.

To improve your provider marketing skills, we highly recommend you read Dale Carnegie’s How to Win Friends and Influence People. Referrals are always the best leads, and it all starts with building relationships.

Get Involved with Your Community

Are you involved with a religious organization, chamber of commerce, or school board? These groups allow you to market your business for little cost. This could include bulletin boards, business cards, flyers, and word-of-mouth.

Another unique opportunity is participating in local health fairs! For a low fee, you could sponsor a small booth and present your products to this interested audience.

Go into the community, identify leaders and influencers in your target demographic, and build rapport. The goal is to become a trusted resource that people turn to for insurance needs.

You can host fun games, giveaways, or activities at grocery stores, food banks, and community centers. Spinning prize wheels are inexpensive but interactive.

You can also partner with health clinics, doctor’s offices, and senior centers to offer educational workshops. Lead with compassion and resources rather than aggressive sales pitches.

Want to go deeper on this topic? Check out this podcast episode.

Participate in a Retail Marketing Program

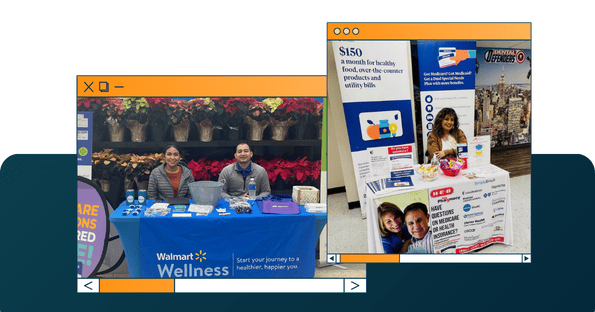

Retail partnerships with major stores like Walmart have become the number one source of leads for many Medicare agents. The foot traffic and community presence make stores an ideal lead-generation avenue.

Our Medicare Sales Director, Jamie Gaskill, recommends that agents walk through potential retail partners like Walmart, dollar stores, and pharmacies to understand senior shopping patterns.

Observe where older customers tend to congregate and linger. Identify high-visibility spots near pharmacy counters, checkouts, or main aisles to position marketing materials for maximum impressions. Locations near senior housing and public transit hubs also tend to see heavy senior traffic.

An essential mindset is seeing retail as planting seeds and nurturing future clients over time. While immediate leads are great, the real value is becoming the familiar local Medicare expert through sustained presence.

Leverage Social Media and Digital Marketing

We all know that technology is increasingly important in the Medicare industry.

Make sure you have a website where people can learn more about you. Set up a free Facebook business page where you regularly share helpful content.

Consider launching a YouTube channel where you explain the basics of Medicare and introduce your company.

There is no magic formula for using social media to sell insurance, so please remember to be realistic in your approach. People need to feel like they are part of a community, and the internet offers you a platform to meet those needs.

The reality is that most people simply don’t care about the intricacies of insurance until they need to purchase a policy. Posting dry, generic insurance advice daily is unlikely to engage or convert followers. Instead, focus on building authentic connections that go beyond insurance.

Copying big brand social media tactics is also ineffective. Slick graphics and overly professional language won’t resonate. Instead, we recommend you play to your strengths as a local expert by sharing behind-the-scenes photos, testimonials, and hyperlocal happenings that big corporations can’t authentically replicate.

If you want to run paid Facebook advertisements, you can read our free guide to learn how.

Utilize Direct Mail Marketing

The price of a 1,000-piece mailer is normally $450 to $500. Let’s assume that out of 1,000 mailpieces, you make 3 Medicare sales. That’s a 3X return on investment!

Even if you sell just one new-to-Medicare policy, you add a new client to your book of business and get your cash back!

Direct mail marketing offers several options. These could include community meetings, T65 campaigns, DSNP marketing, and cross-selling supplemental products.

Our team can help you put together an effective direct mail marketing plan.

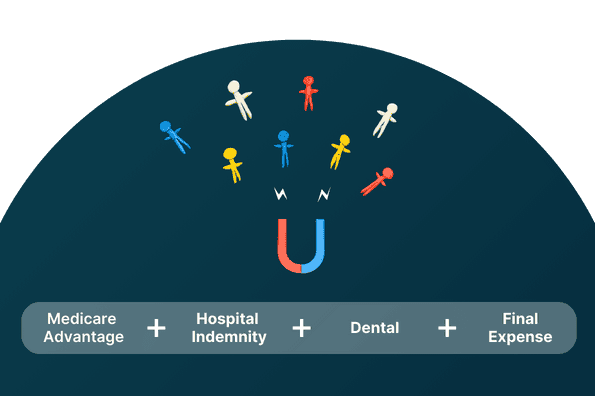

Cross-sell products like Hospital Indemnity and Dental

To maximize your Medicare Advantage sales, consider cross-selling products like Hospital Indemnity, which fills the gaps in your client’s coverage. The premiums are generally pretty low, and the commission is often as much as the first year’s Medicare commissions – doubling your profit!

We have easy-to-use software here at The Brokerage that allows you to bring this up quickly. All you have to do is plug in the client’s Medicare policy, show them the gaps, and then show them how they could be covered by purchasing a Hospital Indemnity policy.

It’s a win-win scenario: You make more money, and your client is more protected.

The same idea could be applied to Medicare Supplements combined with Dental, Vision, and Hearing plans. Since Original Medicare does not offer these benefits, you almost have an obligation to discuss them with your clients.

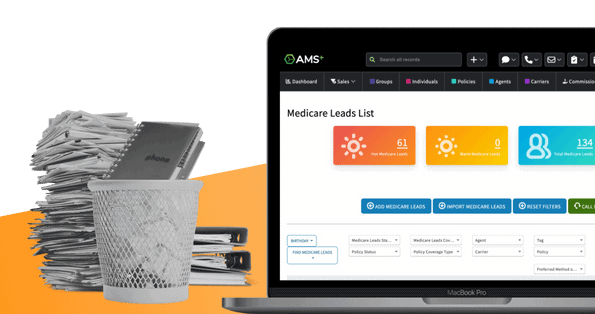

Use a Client Relationship Management System

As your Medicare business grows, you can quickly lose track of your data. A client relationship management system (CRM) helps nurture your client relationships with ease through contact management, sales records, automated workflows, email marketing, and website integration.

This will enable you to track your leads from the first contact to close, make intelligent business decisions based on real-time data analytics, keep in touch with your clients through ongoing drip marketing campaigns, and manage all aspects of your Medicare business.

Did you know that it costs five times as much to attract a new Medicare client than to retain an existing one? Successful agents know that to truly scale their operation, they have to preserve their book of business.

Earn Brokerage Bucks for Marketing Support

At The Brokerage, our agents are family to us, and we support their ongoing growth and success in everything we do.

One of the ways we help agents grow their book of business is through our exclusive Brokerage Bucks program, where you could earn up to $5,400 annually in marketing dollars!

Whether you are selling Medicare Advantage, Medicare Supplements, or Final Expense, you can combine your production each month to qualify.

If you aim for the sales goals above, you will have no problem earning Brokerage Bucks!

Conclusion

The above topics are based on real-life agents who have successfully grown their businesses. Now it’s your turn to choose which strategies best fit into your Medicare business plan and take action.

If you have questions about growing your business, you can learn about partnering with our FMO or contact us here.