As a professional in the insurance industry, you might have asked yourself, “What is an IMO?”

IMO, NMO, FMO, MGA, GA…there are a lot of acronyms to keep up with.

So what is an IMO, and why do you need one?

Feel free to jump around using the links below:

What is an IMO?

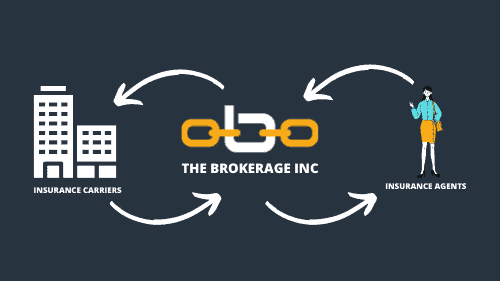

An IMO (Independent Marketing Organization) is a partnership between independent insurance agents and insurance carriers.

The best IMOs will help you with marketing, training, contracting, recruiting, and ongoing support.

They will also have top-level, non-captive relationships with the most popular insurance carriers.

Agents partnered with The Brokerage get ongoing training that includes:

- On-Demand Masterclasses

- Weekly Articles- With new product information and updated content (like this one!)

- Certification Courses

- In-Person Training

- Featured Carrier Spotlights

- Weekly Podcast Episodes

All of this can be found in The Broker Link, our state-of-the-art agent portal available 24/7.

How did it all begin?

In the early days of the life and health insurance industry, most agents were captive.

This model worked well for a while, but a few changes contributed to the creation of the IMO.

- New products were introduced to the market that increased consumer demand.

- Consumer preferences shifted toward unbiased shopping with a broker.

- Insurance carriers wanted to decrease their overhead without decreasing production.

And just like that, the IMO was born.

The Brokerage was among the first IMOs to participate in this new structure.

Why can’t I just work directly with the insurance carriers?

The top insurance carriers require you to maintain a consistently high production volume.

Some carriers will ONLY let you contract with them through an IMO.

For the majority of agents and agencies, there is no reason to aim for a direct contract.

How does an IMO make money?

IMOs are paid directly by the insurance carriers, who pass the full commission on to you.

We only make money when you make money.

That’s right, you keep 100% of your commissions.

What should I be looking for?

When you are looking to partner with an IMO, think about these key factors:

- Experience: How long have they been in business? What is their track record of success?

- Carriers: How many carriers do they offer? Are they the most competitive products?

- Programs: What kind of marketing programs do they offer? Do they know what is working?

- Testimonials: What do other agents say about them? What do carriers say about them?

Conclusion

A good IMO is successful when you’re successful.

Do you have questions about how to find the best IMO for you?

Feel free to contact us, and we will be happy to help.