Are you thinking about selling life insurance?

At the time of writing, the total U.S. consumer debt is at $16.5 trillion, and millions of Americans have family members who depend on them for income. If they were to die, these debts would be passed down to their loved ones.

Selling life insurance is a rewarding opportunity to help individuals and families alleviate this concern and make a generous commission while you’re at it.

Continue reading for our step-by-step guide on selling life insurance.

You can jump around using the links below:

- How much money can you make selling life insurance?

- Get your life insurance license

- Decide which life insurance products you want to sell

- Find a good life insurance IMO

- Prepare for life insurance selling success

How much can you earn selling life insurance?

Selling life insurance is part of the financial services industry, which has a track record of generating more millionaires than any other industry.

One of the reasons that selling life insurance is so lucrative is your ability to make ongoing, residual income. When you work a job earning $18 per hour, your paycheck is the same regardless of how much effort you put into it.

With life insurance sales, you sell a policy and receive an initial commission (a percentage of the premium). Then, you receive partial commissions AGAIN every year you retain that client.

If you can get your “book of business” up to several hundred clients, then you should have no problem making a six-figure income – all while getting to be your own boss! Check out this article that shows you how it’s possible.

Selling life insurance can be a great way to make passive income, even during economic uncertainty. As depressing as it sounds, people are still going to die – and their loved ones need life insurance coverage.

Get licensed to sell life insurance

To sell life insurance, you must become a licensed life and health insurance agent in your state (or any state in which you plan on selling).

The basic insurance licensing requirements include the following:

- Be at least 18 years old

- Complete pre-licensing education

- Pass the state insurance licensing exam

- Pass a background check

If you meet these requirements and are willing to commit to continuing education, you will enroll in an exam preparation course and then pass your state exam.

We have a complete guide for getting your life and health insurance license here.

Decide which products you want to sell

Life insurance is pretty straightforward once you get the hang of it.

At The Brokerage, we focus on four major types of life insurance:

Term Life Insurance

Term life insurance is the most popular and least expensive type of life insurance.

It provides coverage for a set duration of time, called the “Level Term Period”. These term lengths typically range from 10 – 40 years.

If the client dies during the term period, the insurance carrier will pay out the death benefit to the client’s beneficiary. Additionally, the premiums will not increase during the level term period.

Whole Life Insurance

What if your client is interested in life insurance guaranteed to last their entire life?

Whole Life Insurance is the most well-known type of permanent life insurance.

Whole life insurance policies are typically guaranteed to age 121, which means that your client does not have to worry about a term period expiring. Additionally, whole life insurance premiums never rise over the policy’s life.

Whole Life policies come with an additional benefit: cash value accumulation.

In a nutshell, there is a savings account inside a whole life insurance policy that grows over time.

Universal Life Insurance

If your client is interested in permanent life insurance but whole life is too expensive, universal life insurance may be a solution.

With this type of policy, your client has permanent coverage at lower premiums than a comparable whole life policy.

At The Brokerage, there are two main types of Universal Life Insurance: Guaranteed Universal Life (GUL) and Indexed Universal Life (IUL).

Final Expense

Put simply, Final Expense insurance covers funeral costs.

Since these are whole-life policies, your client’s premiums are guaranteed not to rise, and the death benefit is guaranteed to age 121 (100 with some Final Expense products).

Typically, these policies have smaller coverage amounts than traditional whole life – as low as $1,000.

Final Expense is usually marketed and sold to senior clients and it’s a great cross-selling opportunity for your Medicare clients.

Partner with a life insurance IMO

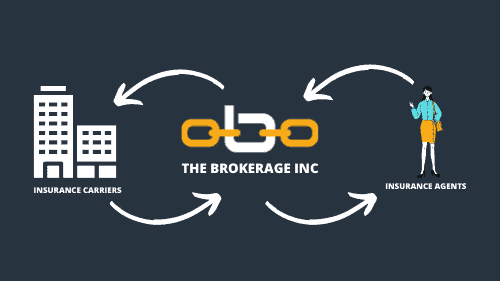

An Independent Marketing Organization (IMO) links Life Insurance carriers and independent life insurance sales agents.

It’s important to partner with a reputable Life Insurance IMO that offers a good mix of carriers and products, fully-vested contracts, training, support, and technology.

Selling Life Insurance can be overwhelming when you’re working alone, and that’s why companies like The Brokerage Inc. exist. A good IMO empowers you to sell more, earn more, and stay independent.

For more information, check out this guide on how to find the best Life Insurance IMO.

Prepare for Success

Once you are licensed and you’ve chosen a Life Insurance IMO, it’s time to prepare for success.

The first thing to do is leverage your network. Let others know that you can now help them and their family with life insurance, and make it easy to share your information.

Secondly, check your IMO’s training and marketing programs to find out how you can kick-start your book of business.

Initially, we recommend keeping your day job and selling life insurance on the side. This removes unnecessary pressure and enables you to focus on building a sustainable business.

At The Brokerage, you can start selling life insurance by setting up a free account in The Broker Link.

There, you can get contracted with life insurance carriers, learn about our exclusive marketing programs, access our on-demand training, and so much more!